It used to be that setting some money aside would cover any surprise medical bills your cat might incur. But as veterinary medical care improves and modernizes, the cost of diagnostic testing, therapies, and preventive care for feline patients has increased dramatically over time. Bills for emergency care to address an intestinal obstruction caused by an ingested foreign body, for example, can easily go into the thousands of dollars, and long-term diabetes management can cost $1,000 a year or more.

Particularly if you have multiple pets, it can be shockingly easy to blow through a rainy day or emergency fund and then have nothing left to weather the next crisis. This is where a pet health insurance policy can be helpful.

Choosing a Plan

Most pet insurance policies cover injuries and illnesses. They come in handy if your adolescent kitten breaks his leg or your middle-aged cat is diagnosed with hyperthyroidism and is going to need lifelong medication.

Keep in mind: The goal of insurance companies is to make a profit and earn money. It can be a fine line to walk when trying to determine the best balance between benefit for you and your cat and not pouring too much money into the policy itself.

Before enrolling your cat in an insurance plan, read through the policy carefully so that you fully understand what the policy covers, what it doesn’t cover, and any exclusions or special rules. For example, some plans require your cat to have a physical exam with a veterinarian before coverage starts.

If you aren’t sure what something in the policy means, ask questions. Every insurance company should provide ways to email or speak to someone to help unravel the legalese and complex terms.

Some things to look for and compare between policies include:

Exclusions are things that the policy doesn’t cover. Also look for bilateral exclusions, such as when a policy won’t cover cataract surgery for your cat’s left eye if she already had surgery in the right eye before signing up.

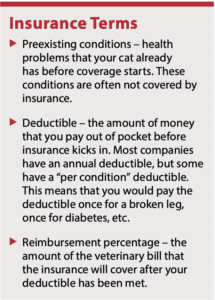

Preexisting conditions are health issues your cat already has when you sign up for an insurance policy. Most pet insurance plans do not cover preexisting conditions. So, if your cat has already been disgnosed with an autoimmune disease, a new plan will likely not cover expenses for these treatments.

Preventive medications like flea and tick or heartworm preventives are often not covered, unless you purchase a rider.

The treatment of preventable diseases that your cat could get if you do not keep him up to date on vaccines is not covered.

Prescription medications and foods are often not covered, except possibly through a rider.

Alternative therapies such as acupuncture, physical rehabilitation, and herbal treatments may not be covered. Some plans do include this coverage in their base policy, and others give you the option to add it as a rider.

Dental cleanings may be considered part of wellness care that is not covered.

Heritable conditions, which are genetically mediated, may be excluded. If your cat is a breed that is at risk for a specific disease, for example, make sure that it is covered.

Not sure what things might be most important for your cat? Ask your veterinarian if she thinks there is anything that your cat may be at risk for over the span of her life. Your veterinarian doesn’t have a crystal ball, but she may be able to help you weigh pros and cons for your individual cat.

The Big Gotcha: Limitations

Most policies cover accidents and illnesses, but some only offer accident coverage (meaning acute injuries). Most plans do not cover routine or wellness care, though some give you the option to add this coverage for an additional fee.

Many policies have a limit to how much money they will cover for your cat. Some plans have an annual limit that resets each year, while others have a lifetime limit. We recommend choosing a plan with unlimited coverage.

It is getting less common, but there are still some policies that may consider a condition to be preexisting upon policy renewal if it was diagnosed before the policy renews. This means that if your cat has surgery for a luxating patella in her left leg this year and it is covered, the insurance may not cover surgery for the right leg next year.

Also keep in mind that most pet insurance policies are reimbursement based. This means that you will need to pay the entire bill up front and get money back from the insurance company later. Most pet insurance policies let you choose a 70% to 90% reimbursement rate of approved services. A few companies do partner with veterinary practices in their network to pay the veterinarian directly.

Saving Money

There are some ways that you can save money on pet insurance plans. See if your current home, auto, or liability insurer has partnerships with a pet insurance company that will give you a discount.

Also ask your employer or any organizations that you are a member of if they offer pet insurance as a benefit.

Some companies offer multi-pet discounts, where each cat’s individual premium will be less if you sign up multiple pets.

You can also adjust the specifics of your plan to impact the monthly premium. In general, opting for a higher deductible or a lower coverage percentage will lower your monthly premium.

Bottom Line

The important thing is to ensure that you have an insurance plan that will help you afford veterinary fees. Nothing is more heartbreaking to owner and veterinarian alike than to be forced to choose euthanasia due to a lack of money to cover the cost of veterinary care.ν